I want to talk about something potentially controversial – but timely – after spending a few days immersed in conversations at Bitcoin 2025 in Las Vegas.

We’re all Bitcoiners. I don’t need to convince you of bitcoin’s soundness or the uniqueness of the Bitcoin network. But I do want to explore how we can do more with our BTC. How to extract more utility from bitcoin beyond simply HODLing it as a store of value.

Many of us feel we’ve escaped fiat decay and taken control of our financial destiny. But in practice, we’re often left cash flow neutral (or worse) with assets we don’t want to sell, and limited ways to tap into their value.

So let’s talk about four approaches to increasing bitcoin’s utility:

- Spending it

- Buying bitcoin-adjacent instruments

- Staking it to earn yield

- Borrowing against it

The case for spending

Bitcoin’s store-of-value status is well earned, but its original purpose was as money. It says so in the very title of Satoshi’s infamous white paper: “A Peer-to-Peer Electronic Cash System.” Ignoring Bitcoin’s payment function risks weakening its potential as the future financial system.

The Lightning Network is the best (current) way to bring bitcoin’s payments vision to life. It enables instant, low-cost global transactions and is growing more robust by the day. I’ve been running a Lightning node for a while now, and while it’s taught me a ton, you don’t need to be a technical wizard to participate.

Even without running a node, you can use Lightning to send and receive bitcoin instantly, with better UX than many banking apps. (And, if you do venture into running your own Lightning node – and I highly recommend it – you can earn modest but real yield through routing fees if you manage channels efficiently.)

Look out for:

- Cash App https://cash.app/ | Possibly the slickest UX and on/off ramp for making payments with bitcoin.

- Lightning Labs https://lightning.engineering/ | Early mover offering a Layer 2 protocol for building Lightning-powered applications.

- Lightspark https://www.lightspark.com/ | Brainpower from the team behind Libra now focused on enabling institutions to scale Lightning payments.

- Umbrel https://umbrel.com/ | An approachable way to run a Bitcoin+Lightning node with an active and helpful community.

The case for investing

If you’re bullish on BTC’s long-term trajectory, you can express that view through exposure to bitcoin treasury companies or structured funds that track bitcoin performance – often with easier access and tax benefits if you invest in a pension or other efficient wrapper (DYOR, not financial advice).

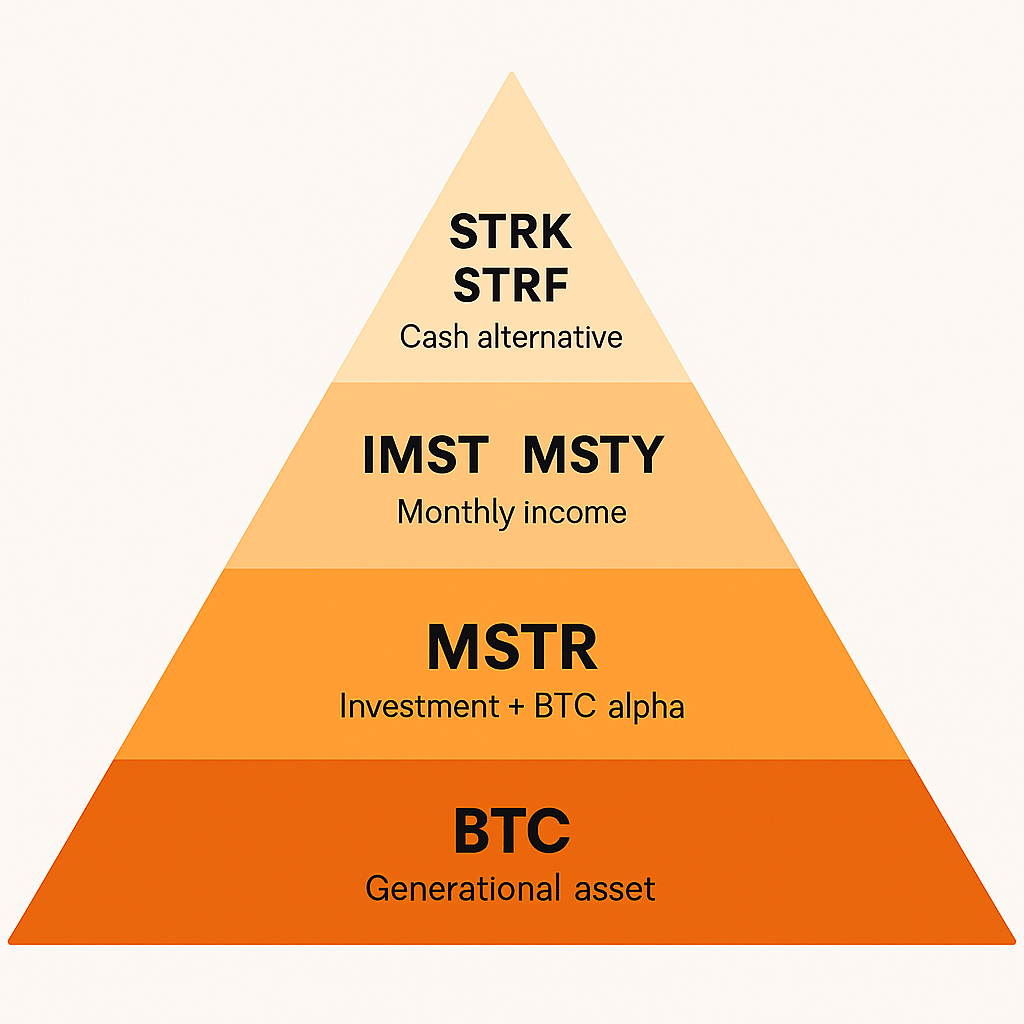

Michael Saylor’s MicroStrategy ($MSTR) is the original Bitcoin proxy. But new contenders are now vying for the crown of the purest and most transparent bitcoin treasury company. Furthermore, products like $MSTY and $IMST have emerged to offer leveraged or derivative exposure, and $STRK or $STRF are pushing the idea of stable, income-oriented bitcoin-backed instruments even further.

I’m personally using MSTR options to speculate with limited capital at risk, but structured funds might be appealing for those seeking passive exposure or looking to diversify their existing portfolio.

Look out for:

- Bitwise https://bitwiseinvestments.com/ | Leading crypto asset manager with thoughtfully designed products, bleeding-edge quants and a commitment to funding open-source development.

- Strategy https://www.strategy.com/ | The OG Bitcoin treasury company. “There is no second best” – Michael Saylor.

- Twenty One https://xxi.money/ | Backed by Cantor Fitzgerald and Softbank, aiming to build the most transparent bitcoin fund yet.

The case for staking

This was the hot (over-hyped?) topic at Bitcoin 2025 – and also the most misunderstood.

Let’s be clear: staking bitcoin is not the same as staking in proof-of-stake systems like Ethereum. Bitcoin doesn’t have a native staking mechanism. So when a provider offers “bitcoin staking” what they really mean is: your bitcoin is being deployed in a strategy that generates yield, and they’ll share a portion with you.

This raises critical questions:

- What is my BTC being used for?

- Is it being lent out, wrapped, or used as collateral?

- Who controls custody?

- Is the yield sustainable – or subsidized?

One standout company building in this space is Acre. You deposit BTC and earn BTC, without needing to convert it into tokens or move off-platform. Behind the scenes, Acre uses secure and decentralized infrastructure to put your BTC to work, with yield coming from demand to rent liquidity for leverage – akin to an on-chain money market. It’s early days, but the design aligns incentives well and emphasizes transparency and user control.

TL;DR If you’re going to stake your BTC, make sure you understand the mechanics and the risks.

Look out for:

- Acre https://acre.fi/ | Backed by Thesis. An on-Bitcoin yield protocol offering native BTC compounding to consumers and institutions.

The case for borrowing

This one almost needs no introduction. If you need cash but don’t want to sell your BTC, borrow against it. The idea is as old as finance itself – securing a loan with collateral – but Bitcoin makes it programmable.

The big concern here is rehypothecation: are your coins actually held 1:1, or are they being reused behind the scenes? Trust and transparency are key. There’s also market risk: you’re using leverage (true, even if it doesn’t feel like it!). If BTC drops, your loan may be liquidated unless you top up your collateral.

Ask yourself:

- Can I support interest payments if my income drops?

- What are the margin requirements and what happens if bitcoin’s value declines?

- Who are the underlying capital providers, and in what circumstances can they exercise rights to my bitcoin?

Still, when done responsibly, this can be a tax-efficient way to fund fiat expenses – or buy more bitcoin – without selling your stack.

Look out for:

- Mezo https://mezo.org/ | Built by Thesis. Bitcoin-backed lending with a promised competitive borrowing rate. Mainnet was launched during Bitcoin 2025.

- Strike https://strike.me/ | The Bitcoin financial products company that never fails to amaze with its ability to ship fast and delight users.

From HODL to Action

Bitcoin is pristine collateral. It’s hard money. It’s digital gold. But for Bitcoin to become the backbone of a new financial system, we need to use it, not just stack it.

Consider how spending, staking and borrowing and experimenting with bitcoin-adjacent products fit within your risk appetite. And let’s help the buidlers out there create a world where Bitcoin powers real economic activity – without compromising what makes it special.

Pingback: Death, Bitcoin and Taxes: Three Certainties in Life | MatadorFin