A thought piece reflecting on a side degen project I ran in 2023 and a potential opportunity for a leading crypto fund manager. Just for fun. All thoughts and opinions expressed are my own.

NFTs [Non-Fungible Tokens] have served as a gateway into crypto for millions. Unlike many digital assets, NFTs don’t require deep technical knowledge to spark curiosity. The appeal of a Pudgy Penguin or an XCOPY 1:1 speaks for itself. Communities have formed around top collections, often delivering outsized returns to those fortunate enough to mint a genesis NFT.

Yet institutional-grade access remains limited. Bitwise was an early mover, launching its Blue-Chip NFT Index Fund in 2021, but there’s still no pathway for deeper, more dynamic exposure aligned with the true nature of this market.

A Strategic Fit for Bitwise

Bitwise was founded to provide clean, compliant and understandable access to digital assets. Applying a fund manager’s mindset to a tech-native domain, they’ve simplified access, reduced friction and built investor trust.

A managed NFT fund would be a natural extension of this approach. NFTs remain daunting even for established crypto investors, facing barriers around custody, pricing and trust. Bitwise has the brand, infrastructure and qualified distribution network to overcome these challenges once again – this time in the rapidly evolving world of Web3 culture and digital collectibles.

Such a fund would differentiate Bitwise strategically. Most institutional managers remain on the sidelines of NFTs, constrained by traditional valuation frameworks and benchmarking fears. Bitwise could step boldly into this space, reinforcing its innovative edge and potentially delivering outsized returns.

The Opportunity: Big, Underserved and Ripe for Structure

At its peak in 2022, NFT sales volume reached $23.7B (Cointelegraph). Although the market cooled in 2023-24, recovery is well underway. Projections estimate the NFT market will reach $35.7B in 2025 and expand to $211.7B by 2030 (Grand View Research), representing a CAGR of over 41%.

Recent high-profile sales illustrate renewed interest: CryptoPunk #3100 sold for $16M (4,500 ETH) and “Fidenza #313” by Tyler Hobbs went for over $3.3M. While these could be considered exceptional, these sales highlight the broader appeal and potential of digital collectibles.

Yet there’s no agreed definition of a “blue-chip” NFT. Even among crypto veterans, passionate disagreements persist. Factors like emotional resonance, historical significance and collector sentiment complicate traditional valuation frameworks.

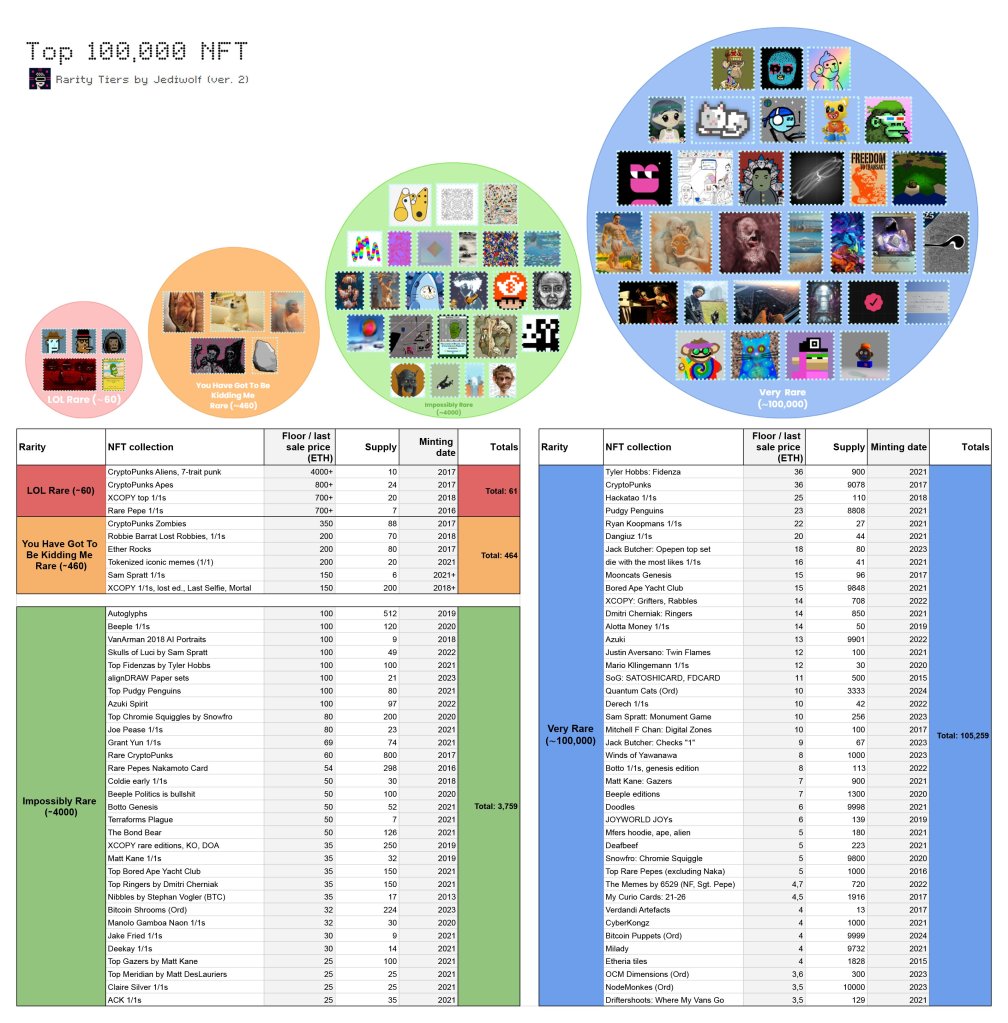

In January 2025, respected NFT researcher/collector ‘Jediwolf’ attempted to rank the top 100,000 NFTs. Initial consensus quickly dissolved into debate, leading Jediwolf to conclude “some people will inevitably be dissatisfied and there’s little that can be done to appease everyone” (tweet). This highlights the complexity and emotional depth of NFT investing – a domain ripe for a structured, data-driven approach.

Bitwise could lead by developing a sophisticated model that blends cultural signals with on-chain data, offering investors diversified, real-time exposure to this opaque asset class.

A Personal Experiment: Building a Model

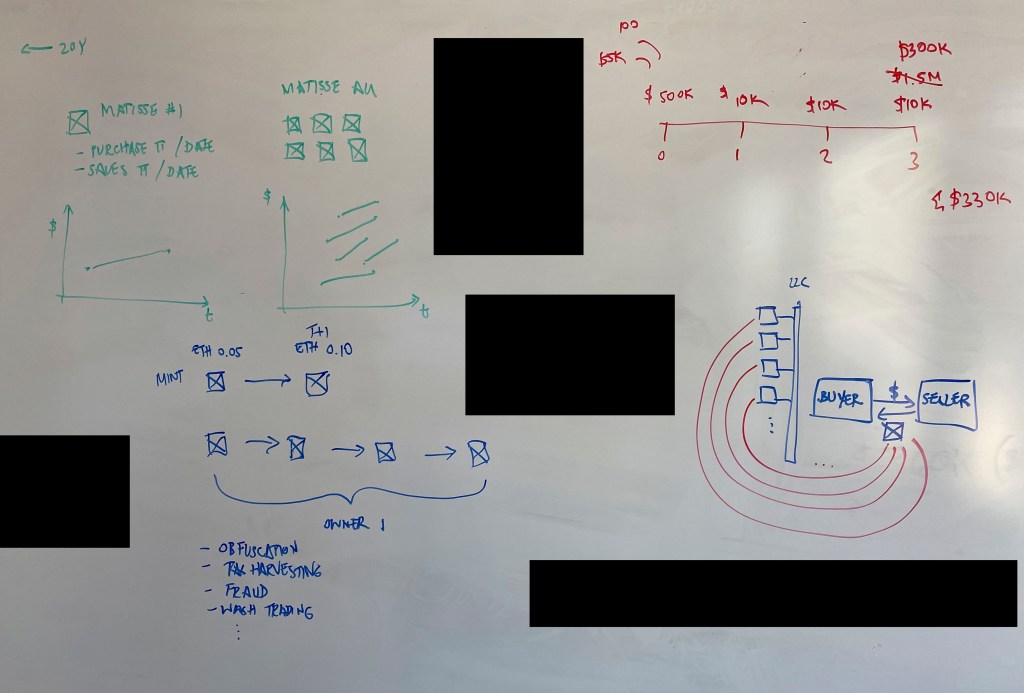

During summer 2023, I attempted to create such a model-driven fund. Friends frequently asked how to invest in NFTs, and I realized I lacked a definitive answer. I began developing a model focused on investing in top NFT collections and exiting based on multiples or market indicators.

Working with Dune Analytics, I analyzed NFT trading pairs – items with observable buy/sell history – organized by collection, rarity traits and historical performance. However, extensive wash trading and bot activity obscured meaningful data, and the rapid emergence of NFTs on new chains (Bitcoin Ordinals, Solana’s Mad Lads, to name only two) quickly outdated my initial models. Continuous updates were clearly necessary, though the concept itself remained sound.

Beyond investor returns, such analytics could also benefit custodians, insurers, and digital and physical auction houses. These stakeholders could contribute to model insights, offsetting operational costs and amplifying industry interest.

Additionally, NFTs often offer utility such as event access, pre-mints, or airdrops – benefits that fund investors could directly enjoy, providing tangible value beyond price appreciation.

Challenges (and Why Bitwise Is Better Equipped)

Despite initial enthusiasm, my project stalled due to the required upfront capital, regulatory uncertainty and limited short-term returns. Investors showed intrigue, but hesitated without institutional backing. I shelved the idea, until a chance encounter at a recent crypto event brought it back to mind.

Bitwise – unlike individual entrepreneurs – possesses the infrastructure, trust and regulatory expertise needed. Still, risks remain significant. NFTs carry reputational and emotional weight – one controversy can rapidly depress floor prices.

Practical questions also persist: What regulatory jurisdiction will the fund choose, and how will it affect investor eligibility? What rights will investors have over the NFTs? Issues around intellectual property, usage, airdrops, and perks must be addressed transparently.

Liquidity also poses a challenge. Unlike most Bitwise products, NFTs from top collections often lack immediate market liquidity. Clear communication regarding lockups, redemption terms and valuation will be essential, though liquidity should naturally evolve as the market matures.

Time to Go Beyond the Basics

Bitwise’s existing Blue-Chip NFT Index Fund, based on quarterly rebalancing, was appropriate in the market’s early days. Today’s NFT ecosystem demands more sophisticated, data-informed models capable of capturing real-time nuances. Get this right and the potential is enormous!

A Next Frontier

Launching a managed NFT fund aligns perfectly with Bitwise’s mission of democratizing crypto investing. Leveraging its strengths – education, compliance, trust – Bitwise could confidently pioneer this next frontier in digital assets.

So, Hunter – how about it? 🙂