The following text is part of a summer 2022 research piece that has been reproduced with kind permission of co-author Porter Orr.

How do Platform Companies think about Data Sharing and how does this inform their Organic vs. Partnership Growth Strategy?

Abstract

While this analysis mainly focused on US companies – such as Amazon, Shopify, Square and Stripe – and their activities, the conclusions summarized herein can be applied more broadly and are especially relevant for non-US companies looking to break into North America. The authors note upfront three key takeaways from this research:

Product companies need to commit to fully migrate to a platform company mindset to benefit from network effects.

- The perception and reality of trust are very clear to consumers. If correctly exploited, network effects can exponentially grow marketplace value, but they work both ways when trust is eroded. Consistency is therefore key.

- A successful platform company not only solves problems for its users, but continuously captures and uses data to create new complements.

Open and fair marketplaces that merge data and lean into third party developers are likely to be the most successful in creating long-term value.

- The most successful platform companies lean into third party developers to solve problems that are not aligned to their core capabilities. This enables the value of the marketplace to be greater than the sum of its parts.

- Merging new sources of data is ethically sound if done for the benefit of your users, often uncovering new problems unknown to your customers.

- Open and fair marketplaces have endured and continue to create long term value most effectively. In well managed marketplaces, this does not necessarily prevent the platform company competing directly with partners.

In North America ethics and trust are especially important. The upsides and downsides are likely to be significantly enhanced compared to existing core markets.

- Merging data is commonplace in North America. This is table stakes to simply compete with incumbent platforms.

- Companies must maintain a high ethical bar that is never ignored for short term gain. This requires incredible discipline, but is worth it.

The core part of this analysis is broken into three sections:

- Product vs. Platform Mindset, Trust and a System Dynamics View

- Key Takeaways of how Successful Platforms Operate with Data

- What Strategic Considerations Exist for US Competitors?

What is a ‘Platform’?

For the purpose of this analysis, we chose to use the definition provided by Bill Gates1, namely: “A platform is when the economic value of everybody that uses it, exceeds the value of the company that creates it.”

We also leaned into the concepts provided within McAfee and Brynjolfsson’s epic book ‘Machine, Platform, Crowd‘ regarding the general features that platforms employ:

- Complements – Provide numerous solutions which are adjacent to the core product.

- Superior UI/UX – User interfaces (UI) and user experiences (UX) that are top-tier.

- Network Effects – Harness the power of network dynamics which systematically reenforce growth of demand, especially in two-sided or multi-sided marketplaces.

- Unbundling and Rebundling – Dissecting or combining products and/or features, resulting in ability to serve unique and niche customer problems at scale.

- Rapid Combinatorial Innovation – Continuous innovation of novel solutions is empowered with insight from an ever-increasing wealth of data, then often solved by combining existing platform capabilities in new ways.

- Platform Stacks – Platforms are often built on other platforms, which harness network effects not only to further drive demand, but also increase breadth and depth of the solution provider.

- High Switching Costs – When designed well, end users and partners usually have significant barriers when considering a change to another solution.

We further define a Core Offering to be the main product with which a company started. In-house complements are additional solutions that are now provided on the platform, which are internally branded. Marketplace complements are additional solutions which have been built on top of the platform by third party developers.

Product vs. Platform Mindset, Trust and a System Dynamics View

Moving from closed to open.

There is a subtle shift that is required for a company that is growing from a product based company to a platform company. For a product company, the goal is to maximize user value by developing the best solution to the users’ problems. For a platform company, the goal is to maximize user value, however the method of how to deliver that solution may vary. As the breadth of complements expands away from the core product offering, the platform company may build, partner, acquire, or otherwise depend on a third party marketplace offering.

The most effective platform companies embrace this shift to create an organizational culture that reinforces this new open mindset.

The imperative of building and maintaining trust.

In addition to embracing this open mindset, platform companies need to build and maintain trust with all user groups and be aware of the risk they face when violating that trust. When the gap between what a company advertises and what it actually practices widens, so does the probability of trust erosion. If trust degrades, then the activity of all user groups (customers, developers, and partners) will decrease, directly affecting both short term and long term value. As a result, platform companies risk more when violating trust than product companies, because the effect is amplified across all user groups at the same time.

Simply put, the network effects that help platform companies grow rapidly can also make them shrink rapidly if trust is violated.

Platform company successes hinge on core data insights.

A product company typically views its long term success by how well it solves a problem for a customer. The better the solution, the more likely the customer is to buy it. The data the product generates helps the company understand what features to add or improve on the core product.

By comparison, a platform company views success on two metrics: (i) how well a solution solves a given problem, and (ii) how well it uses the data generated to create new complementary solutions. Thus, for a platform company, data is not just used to improve a core product offering, but also to grow the entire platform. This directly drives the platform’s main purpose of creating value for all users that exceeds the value captured by the product company.

Platforms – A system dynamics perspective.

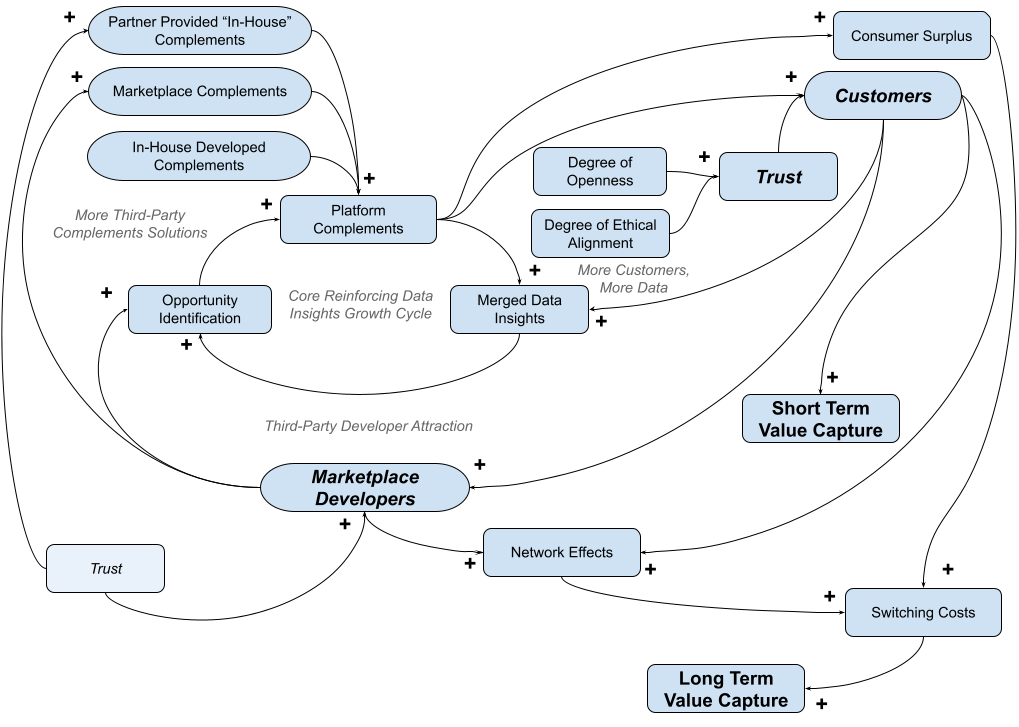

To help understand a platform system and its relationships, see the below visual map.

At the core is the ‘reinforcing data insights growth cycle’, a reinforcing cycle that begins as new complements are added and their data streams merged. As data insights increase this drives an increase in opportunity identification and developments that create even more complements and data. In addition, the model adds ‘degree of openness’ and ‘degree of ethical alignment’, both of which directly influence trust and authenticity. As a result, the diagram shows the effect these three components have on creating both short and long term value.

System Dynamics Note: In the above system map, a ‘+’ indicates the correlation between two variables. In other words, if ‘Platform Complements’ increases, then ‘Merged Data Insights’ increases. In addition, if ‘Platform Complements’ decreases, then ‘Merged Data Insights’ decreases. Additionally, there are several reinforcing loops, such as ‘Core Reinforcing Data Insights Growth Cycle’. These loops create ‘flywheels’ that can either help or hurt the company depending on the directions of the variables that create the loop as they either grow or shrink.

Key Takeaways of how Successful Platforms Operate with Data

Maximize customer value by implementing the best solution to drive data generation.

As Figure 1 depicts, the core of a platform company’s success hinges on creating complementary solutions that solve a wide array of problems for customers. By providing superior solutions, more customers will adopt the solution.

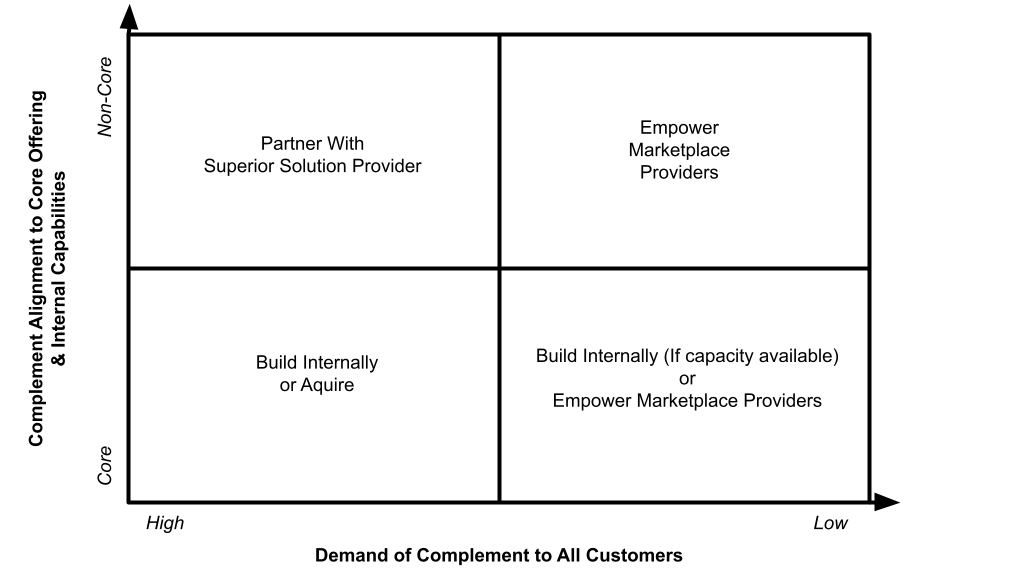

As the knowledge and experience of platforms has evolved over the past 10+ years, so too have the methods to grow a platform. In the past, companies aimed at building all in-house complements themselves (or acquiring them), then providing a marketplace. Doing so enabled short-term revenue maximization by capturing all marginal profit. However, as the number of superior platforms have grown, some companies have shifted their strategies on when to build internally, when to partner, and when to outsource to the marketplace. The below diagram provides a framework for this.

As depicted in Figure 2, in today’s marketplace, wise companies wishing to implement and maintain a platform are willing to outsource to a strategic partner complements that are in high demand for platform customers, but are not highly aligned to the platform company’s core set of capabilities.

Pursuing this strategy enables the platform company to:

- Provide the best possible solution to their customers, which drives growth and consumer surplus.

- Decrease the time and cost to market, and ongoing maintenance costs.

- Reduce the ongoing operational cost of maintaining their own competing solution, and doubling down on what they do best.

- Maintain a forward leaning brand image with customers staying within its ecosystem.

Gather and merge all data for the benefit of the users.

Effective platform companies understand the importance of cohesive data, and use it for the right ethical reasons. As superior complements are added, the data they generate increases two fold. First, any complement pulls in new types of data provided through its functionality. Second, the volume of customers using the complement increases, because they are superior in performance to other substitutes.

Successful platform companies combine these various data streams to gather the most cohesive understanding they can of the customer. This insight then enables the platform company to mine for new, previously unknown, problems; often, these are problems that customers might not even know they had. Then, either using existing complement or partner functionalities, the platform company can use combinatorial innovation to quickly solve the problem and offer a solution to their customers.

Key is the willingness of the platform company to merge various data streams, but doing so for the right ethical reason. Effective platform companies see the purpose of blending data is to help their customers.

Maintain a fair marketplace to generate secondary solutions with rich platform data.

The most successful platform companies that employ marketplaces do so openly and fairly. By providing access to a rich source of platform data, developers can also create secondary solutions that further increase the demand of the entire platform. Moreover, well managed platforms also seek to align incentives with the developer, providing mutually beneficial terms, revenue sharing agreements, and operational practices. In addition, experienced platform companies try to minimize the copying of existing solutions on their marketplace. If they do choose to compete with a third party complement, they do so openly and fairly, marketing their in-house solution on level terms with the solution of the third party developer.

Operating a marketplace with this mindset shows a level of platform economic savvy which maximizes long term value capture for the customer, developer, and platform company.

Companies with unique data have significant leverage as regulation and progression open up sectors such a financial services.

In a world of Open Banking (as one contemporary example) massive datasets will begin to commoditize access to, and the insights derived from, financial data. With rapid growth of Open Banking data, many entrepreneurs have begun to build and offer solutions that are highly attractive to customers. Many of these customers may overlap with the platform company’s user base. To compete, platform companies need to look towards the strength of their core offering. Platform companies with an existing, unique data set hold significant value and attractiveness to these new up and coming Open Banking empowered start-ups as a solution to partner or integrate with.

What Strategic Considerations Exist for US Companies?

Embrace merging and using data from users for users.

A high ethical standard of data usage will be key to the long term success of any company’s expansion within the US. This might sound like a contradiction – or even form a potential ethical barrier – against merging data streams from core products and complements.

This should not be the case. In fact, customers that already trust a company to manage their data securely and privately also desire ever improving products and complements. They desire value. The only way to deliver well on these improvements and growth opportunities is to merge data. In fact, for a newcomer to compete effectively in the US against incumbents and other platform providers in adjacent markets, it is essential. It is table stakes and not doing so would likely mean less informed product capabilities, reduced complements growth, and lower customer adoption over time.

Ethical redline considerations.

A strong commitment to ethical behavior and practices, especially as it relates to data and privacy, can be a differentiator vis-à-vis other large enterprises. It is, however, imperative for a company to stick to these commitments, to ensure trust with all users of the platform does not erode. This might mean making short term revenue sacrifices, or possibly taking an unpopular stance on contentious issues, as Apple famously did when requested by the Federal Bureau of Investigation to circumvent its own device security measures3.

There has been no point in North American history where trust in institutions has eroded faster than it has over the past several years. The costs for violating this trust is massive for companies when they find themselves on the wrong side of the fence. Meta with the Cambridge Analytica4 scandal, Uber5 and the Me Too Movement6, systemic racial inequality across many enterprises, all means maintaining trust with customers has never been so difficult, or so critical.